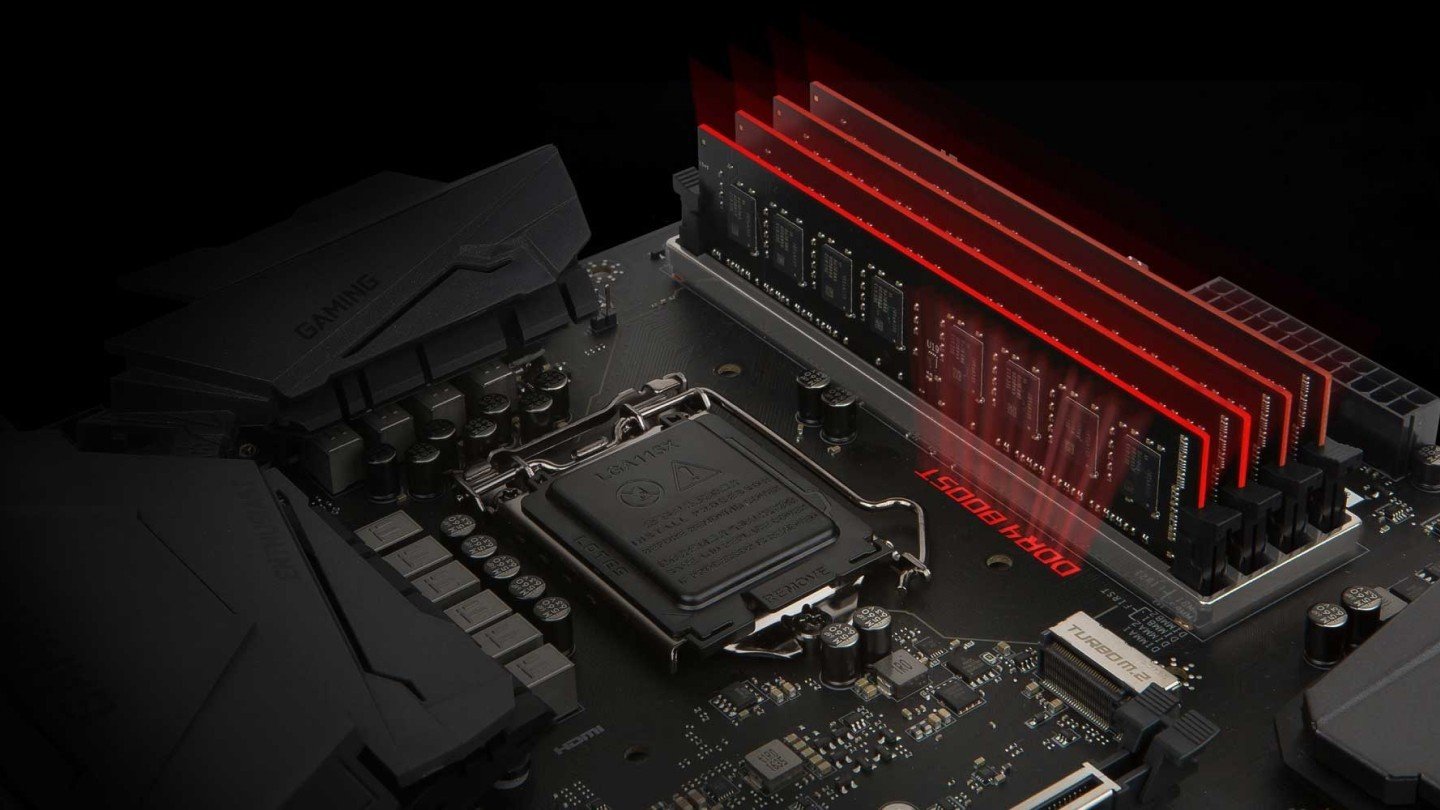

Global leaders in DRAM manufacturing—Samsung Electronics, SK Hynix, and Micron—are set to bring about a transformative change in the memory landscape. By the end of 2025, they are expected to cease production of DDR3 and DDR4 modules entirely, shifting their focus to next-generation DDR5 and high-bandwidth memory (HBM) technologies.

Image: nazya.com

Image: nazya.com

The decision to abandon legacy memory standards could trigger a shortage of DDR3 and DDR4 as early as mid-2025. Experts predict that once production stops, supply chains will face significant pressure, with Taiwanese manufacturers like Nanya Technology and Winbond stepping in to fill the gap. Despite their efforts, these companies may not be able to fully address the anticipated shortfall.The driving force behind this move is the evolving needs of the tech industry. Leading manufacturers are now prioritizing high-performance memory solutions tailored for server applications, AI workloads, and cloud computing. To align with this trend, Winbond is planning to adopt a 16-nm manufacturing process, allowing it to produce advanced 8-gigabit memory chips.According to Nanya Technology, the DRAM market is expected to hit its lowest point in the first half of 2025 before rebounding as demand grows and inventory management improves. Moving forward, DDR5 and HBM are poised to dominate, offering superior performance and energy efficiency.Although Samsung and SK Hynix are steering clear of older standards, other players, such as China's CXMT, might take up the slack in the DDR4 market. Yet analysts remain skeptical about whether this can fully offset the withdrawal of major players. Consequently, the shift to DDR5 seems unavoidable, with users depending on DDR3 and DDR4 potentially facing rising costs and constrained access in the near future.

Lebedev "Mighty Semchan" Semyon

Lebedev "Mighty Semchan" Semyon

0 comments